Investment Ideas You Can Trust

Fundamental Analysis of Spinoffs, Special Situations & Activist Ideas

-

-

- Spinoffs

- Insider Purchases Buying Change of Management

- Distressed Credit

- Splitoffs

- Change of Managements/ CEO Change

- Merger

- Squeeze Outs

- Deep Discounted Rights Issues

- Activist Ideas

- Rights Offering

- Post Bancruptcy Investment Analysis

- Tender Offers

- Reverse Morris Trusts

-

- The Edge’s Focus is on You, Saving You Time & Money

- Consistent Outperformance by the Model Portfolio Provides ROI

- Multi Skilled Analysts Provide Intelligence, Keeping You Ahead of Peers

-

A valuable product and service for our process in terms of early insight to global events & idea generation…

- Portfolio Manager, $1bn Event Driven Fund, Boston

-

Intelligence and trust are both sadly lacking in our industry right now. The Edge consistently brings both…

- NY Mutual Fund

-

The Edge’s research is a critical component of our idea generation…

- Shayan Mohammadi, Chief Investment Officer, Tessellation Capital Management, San Francisco

-

A comprehensive analysis of corporate activity in one detailed monthly report…

- Chand Sooran, Value Investor, New York

-

Being clients for over 5 years and given we’ve over $26bn AUM and 20 analysts, you’re [The Edge] in the extremely rare position of being the only external advisor we have…

- Portfolio Manager, $25bn NY Investment Management Firm

-

Saving time on analysis with a trusted partner makes a huge difference on optimizing capital for investing…

- Cory Janssen, Investor & Co-Founder, Investopedia.com

-

The Edge is an excellent source for serious asset allocators looking to complement their own diligence of Special Situations…

- Tom Hendrickson, Chief Investment Officer, Sunsetter Capital, Canada

OUR Products

Translating Research into Actionable Intelligence. Profitable Investments for Global Money Managers

The Edge look at and analyzes ideas in three very under-covered areas:

1) Spinoffs – the creation of an independent company through the distribution of new shares of an existing business or division of a parent company.

2) Special Situations – an unusual occurrence that has a significant likelihood of changing the future direction of a company and materially affecting its value.

3) Activist Investing – buying a sizable portion of a company's stock with the intention of exerting pressure on the management group to make a particular set of changes to the business.

Jim Osman

Portfolio Lead

Jim founded The Edge® in 2005 and leads the analysis, business transactions, and ideas process. He has one simple goal: Return on investment (ROI) for the Edge's client business partners.

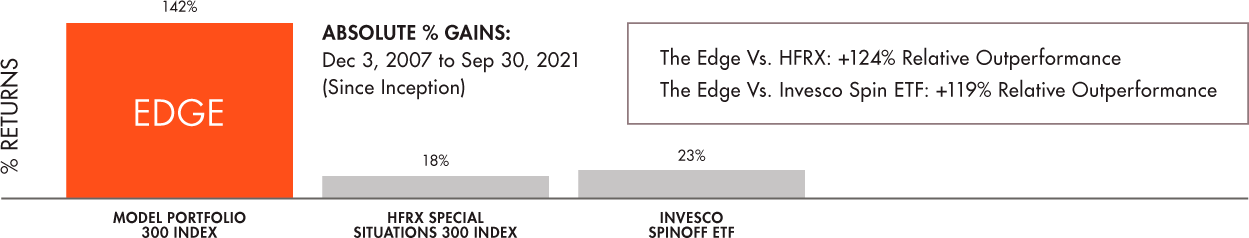

He has helped grow The Edge’s partners’ Assets Under Management (AUM) and contributed to their returns, significantly outperforming peers. The Edge’s Model Portfolio is used as accountability for all high conviction recommendations and it has beaten the relevant indices since inception.

+1 (973) 867 7760 jo@edgecgroup.com

Companies we Have covered

NPR - Planet Money: Why companies spin off

Feb 8, 2023

Conferences

The Edge Alzheimer’s Fundraising Conference

On November 17, 2022, The Edge held their annual conference to fundraise for The Alzheimer’s Association (NYC Chapter). Through the generosity of attendees, The Edge beat last year’s raise with a total of $15,850. This year’s guest speakers included… read more

Contact / Request Info:

FEATURED IN